WHAT IS NONRESIDENT ALIEN?

What is a Nonresident Alien?

The term Nonresident Alien refers to individuals who are neither citizens nor permanent residents of the United States but reside there temporarily for specified purposes, such as education, work, or family visits. Understanding the characteristics and implications of this status is essential for individuals who find themselves categorized as nonresident aliens.

Benefits and Responsibilities of Being a Nonresident Alien

Being classified as a Nonresident Alien comes with distinct benefits and responsibilities. Some of the key points to consider include:

- Legal Rights: Nonresident aliens have certain legal rights within the U.S., including the ability to study or work based on their visas.

- Tax Responsibilities: They are primarily responsible for adhering to tax regulations, which will be covered in more detail in the following sections.

- Healthcare Access: The ability to access healthcare services may vary depending on the state and the specifics of their visa.

Understanding these elements can help nonresident aliens navigate their stay in the U.S. effectively.

"Navigating the complexities of being a Nonresident Alien requires careful consideration of legal and financial responsibilities."

Nonresident Alien: Key Aspects

Eligibility Criteria

To qualify as a Nonresident Alien, the individual must meet specific eligibility criteria based on their visa type, the purpose of their stay, and the duration of their residency in the U.S.

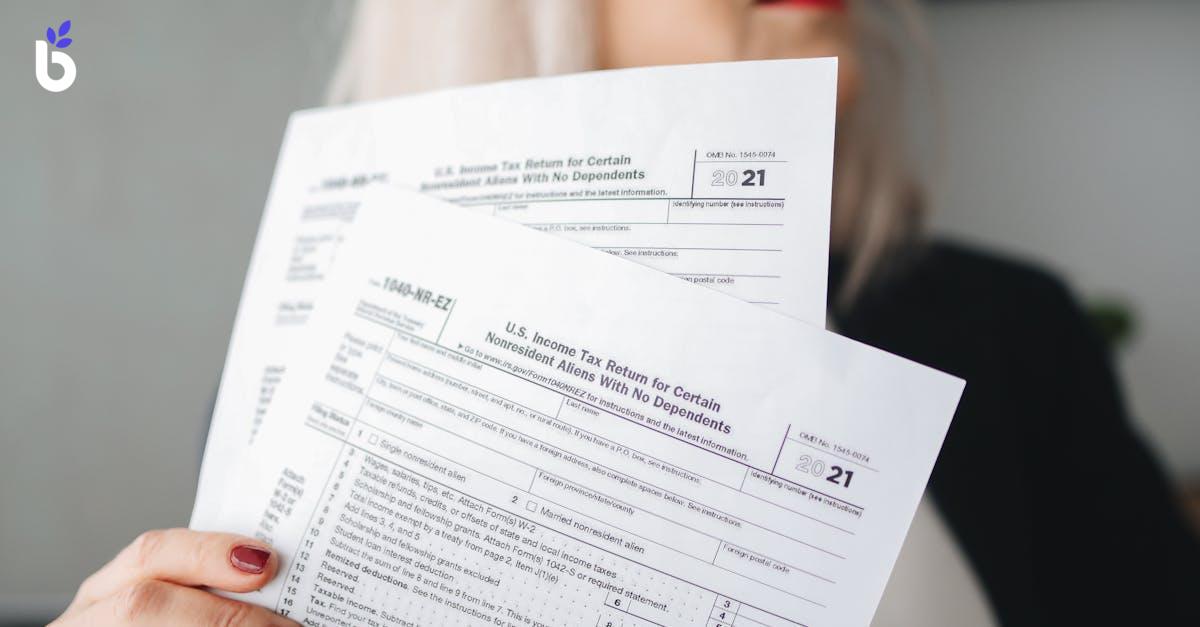

Tax Implications

Nonresident aliens are typically taxed only on their U.S.-sourced income. Familiarity with local tax obligations is crucial to ensure compliance and avoid potential penalties.

Legal Rights and Limitations

While nonresident aliens enjoy certain rights, there are limitations concerning immigration status, employment, and access to certain benefits.

FAQs

How does one qualify as a Nonresident Alien?

Qualification hinges on various factors, including the individual’s visa type, the intent of their stay, and the duration of residency within the United States.

What are the tax obligations for Nonresident Aliens?

Nonresident Aliens are responsible for paying taxes solely on income derived from U.S. sources, which may differ from that of residents or citizens.

Can Nonresident Aliens apply for permanent residency?

Whether a Nonresident Alien can apply for permanent residency depends on personal circumstances, including their visa status and eligibility for change of status.

Is healthcare provided to Nonresident Aliens?

Healthcare access for Nonresident Aliens can vary based on the nature of their visa and applicable state healthcare laws.

Tip: Staying informed about visa regulations and tax obligations is essential for avoiding legal complications. Always consult with immigration and tax professionals to ensure compliance with U.S. laws.

Take control of your business today

Explore BizCRM App and start your journey towards business success.